La industria de la hojalata de China ha experimentado una evolución notable en las últimas dos décadas. Este recorrido se inició a finales del siglo XX y principios del XXI, mucho más tarde en comparación con otros materiales siderúrgicos. La historia mundial de la hojalata se remonta a su primera aplicación en Alemania durante el siglo XIV para el envasado de alimentos, seguida de importantes avances en el Reino Unido durante el siglo XVII. Posteriormente, Estados Unidos y Japón encabezaron el crecimiento de la industria, y China emergió gradualmente como un actor clave.

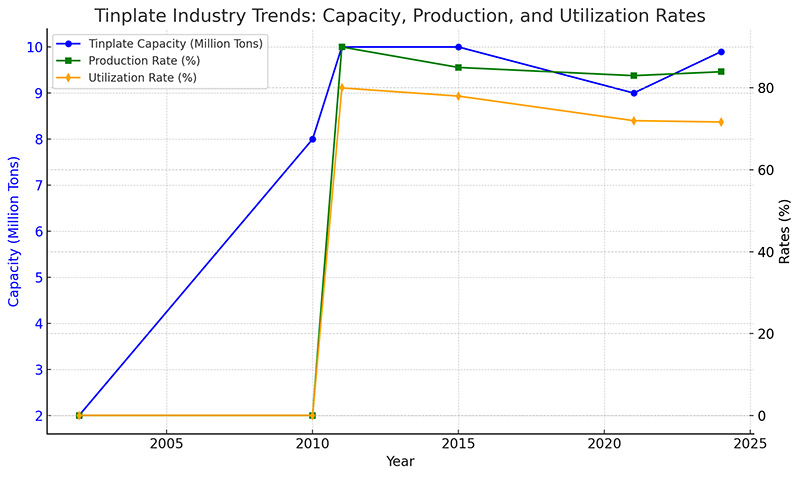

La capacidad de producción de hojalata de China se ha ampliado significativamente, de 2 millones de toneladas en 2002 a más de 10 millones de toneladas en 2015. Según la encuesta de Mysteel de 2023, la capacidad total de hojalata del país alcanzó los 7,32 millones de toneladas, y el este y el norte de China representan el 75% de la producción. Las empresas de propiedad estatal tenían una cuota de mercado del 23 por ciento. En particular, se prevé que la nueva capacidad aumente un 8,88% en 2024, y se esperan adiciones sustanciales de capacidad en 2025, lo que indica una intensificación de la competencia en el mercado.

En 2024, se espera que la capacidad de hojalata y acero sin estaño de China crezca un 9,39%, alcanzando una capacidad efectiva de 9,9 millones de toneladas, una reducción de 290.000 toneladas debido a la eliminación gradual de líneas de producción obsoletas. Históricamente, la producción de hojalata de China alcanzó su punto máximo entre 2011 y 2021, pero enfrentó una desaceleración debido al exceso de capacidad y los desafíos de rentabilidad. Los volúmenes de exportación aumentaron en 2011, multiplicándose por diez, pasando de 80.000 toneladas en 2010 a más de 800.000 toneladas en 2011. Sin embargo, la expansión excesiva sin igualar el consumo interno generó una competencia feroz, lo que obligó a muchas empresas a suspender la producción o cerrar por completo.

Los datos de Mysteel revelan que en octubre de 2024, la tasa de producción de hojalata se situó en el 83,95%, con una tasa de utilización de la capacidad del 71,67%, lo que refleja una disminución mensual del 3,13%. La producción de hojalata ascendió a 44,43 millones de toneladas en octubre, mientras que la producción acumulada de enero a octubre alcanzó 4,3166 millones de toneladas, un aumento interanual del 11%. Asimismo, la producción de acero sin estaño experimentó un crecimiento significativo, aumentando un 37,81% interanual. Estas cifras resaltan la recuperación gradual y la expansión de la oferta impulsada por la reanudación de operaciones y nuevas líneas de producción.

Los márgenes de beneficio de la industria de la hojalata de China se han reducido gradualmente a lo largo de los años. Los costos de producción de hojalata están influenciados por los precios de las materias primas, en particular el acero laminado en caliente y los lingotes de estaño. De 2021 a 2024, los costos promedio de producción fluctuaron significativamente, y las ganancias promedio por tonelada disminuyeron debido a los lentos ajustes de precios en los mercados posteriores. En 2024, el costo de producción promedio se situó en 5.700 yuanes/tonelada, mientras que el beneficio promedio fue de 396 yuanes/tonelada, lo que indica desafíos continuos para mantener la rentabilidad en medio del aumento de los costos de las materias primas.

Si bien la industria de la hojalata enfrenta presiones de oferta a corto plazo debido a la expansión de la capacidad, estos cambios podrían impulsar ajustes estructurales a largo plazo. A medida que se reemplacen las líneas de producción obsoletas, se espera que la industria avance hacia una dinámica equilibrada de oferta y demanda. Estos desarrollos se alinean con los objetivos de China de lograr un crecimiento de alta calidad y sostenibilidad en el sector de envases metálicos.

Con estas tendencias transformadoras, la industria de la hojalata está preparada para seguir siendo un componente vital del panorama industrial de China, adaptándose a las demandas del mercado global y avanzando hacia un futuro más verde y competitivo.