As of mid-June 2025, the U.S. domestic steel market is navigating a turbulent period, largely due to recent adjustments in federal trade policy. The Biden administration's announcement of higher tariffs on steel and aluminum imports from China is already impacting both raw material prices and market sentiment.

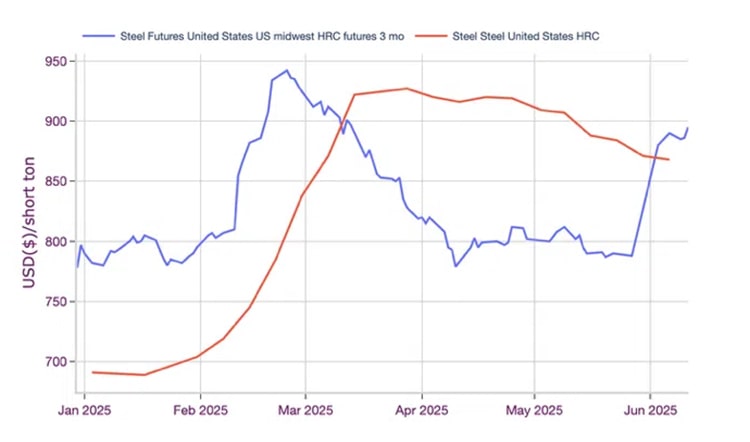

According to data from MetalMiner, prices for hot-rolled coil (HRC) steel in the U.S. saw moderate gains in early June but have since shown volatility. The average domestic HRC price is currently hovering around $780 per short ton, with analysts citing policy changes as a key influence.

“Steel buyers are now holding back on large-volume purchases, waiting to see how tariffs will affect pricing in Q3,” said Lisa Gordon, Senior Steel Analyst at MetalMiner.

In comparison, Chinese steel remains significantly cheaper even after including shipping and estimated duties, creating continued pressure on domestic mills.

While some U.S. steel producers welcomed the move as a protective measure for local industry, downstream manufacturers and OEMs expressed concern.

Jim Rowe, procurement director at an Illinois-based appliance manufacturer, noted:

“We’ve already seen quotes for sheet metal jump by nearly 8% since the announcement. It’s squeezing our margins.”

On the supply side, mills like Nucor and Cleveland-Cliffs have publicly supported the Biden administration’s decision, suggesting it may help stabilize U.S. production rates and protect jobs.

The decision to raise tariffs—doubling some duties from 25% to 50%—also complicates trade relationships, particularly with Asian suppliers. Many foreign producers may seek to redirect their exports to Europe or Southeast Asia, potentially altering global steel flows.

Analysts at CRU Group believe the measures could be part of a broader strategy to push for higher sourcing localization and limit dependence on lower-cost foreign material. However, they also warn that American consumers could face higher prices on finished goods like tinplate canned foods, automotive parts, and construction materials.

Moving forward, industry watchers are keeping a close eye on several factors:

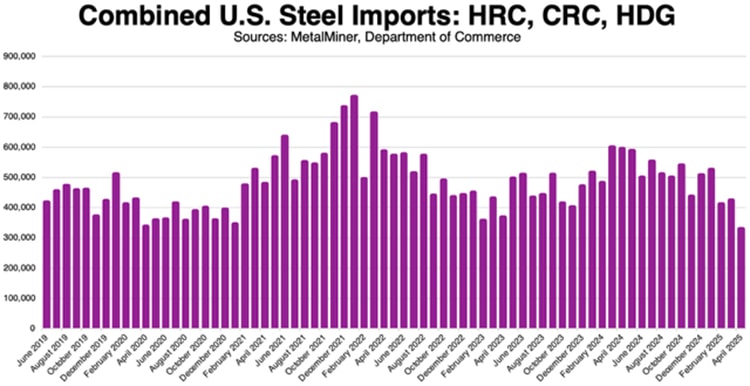

Import volume changes post-tariff enforcement.

Domestic mill production levels—can they meet demand without sharp price increases?

OEM pricing behavior, especially in high-volume sectors like automotive and consumer goods.

Despite mixed opinions, the consensus remains that the new trade actions will have ripple effects throughout the metals supply chain.

“We’re not just talking about tariffs on steel — we’re talking about cost pressures that affect packaging, appliances, vehicles, and infrastructure,” Gordon added.